The topic of financial planning is often

shrouded in confusion.

That’s why people avoid discussing it. It’s just human nature.

Standard deviation? Amortization? The difference between a testamentary and charitable remainder trust? Most of us weren’t taught these terms in school. Yet we’re expected to make major, life-impacting decisions regarding them. The stakes are too high to leave things to chance. At Wealth Bridge Advisory, our mission is twofold: to help you take an active hand in reaching your financial goals and ensure that you clearly understand every step along the way.

We’re here to preserve, protect, and perpetuate your wealth — and we do so by tailoring an approach that’s as unique as you are.

We’ll help you:

PRESERVE your wealth through Retirement Planning:

- Planning as if you’ll live to be 100

- Planning so you won’t outlive your financial resources

- Providing a lifetime income that keeps pace with inflation

- Providing liquidity when needed

- Utilizing all of your assets…including your housing wealth

- Coordinating with your Social Security benefits

PROTECT your assets through Insurance Planning:

- Protecting against the downside of the market (annuities)

- Protecting your family (life insurance)

- Protecting your income (disability insurance)

- Covering the costs of your healthcare (long-term care insurance, Medicare planning)

- Coordinating this with your Retirement Plan

PERPETUATE your assets through Investment Planning:

- Understanding your investing comfort level (risk assessment)

- Planning for growth, when needed, to keep pace with inflation

- Proper diversification

- Providing access to World-Class money managers

- Leaving a legacy…how you will be remembered

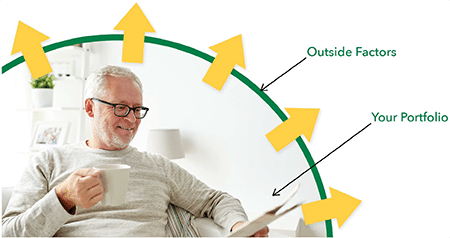

Proactive vs. Reactive Investing

Our investment philosophy is built around the idea of Proactive — as opposed to Reactive — Investing. What’s the difference? It’s simply a matter of understanding the things you can — and cannot — control.Proactive Investing

For instance, there are many factors over which you have total control:

- Your investment objectives

- Your risk levels

- Your asset allocation

- Diversification

- Your attitude and commitment

- Your choice of advisor

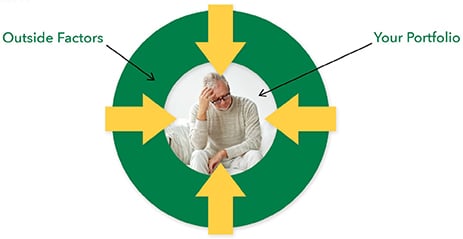

Reactive Investing

Yet there are other factors over which you have no control whatsoever:

- World events

- Corporate profitability

- The economy

- The markets

- Interest rates

- Housing starts

- Political impacts

- Energy prices

When you focus only on external factors, you’re in a constant state of “reacting” to events — you’re operating from a position of anxiety and fear. We call this Reactive Investing.

On the other hand, when you focus on the factors fully within your control, you’re in charge of the process — you’re operating from a position of stability and confidence. We call this Proactive Investing.

And it’s the only type of investing we do at Wealth Bridge Advisory.